Choosing colors for each chart separately creates confusion. Using a Ethereum price prediction 2026 legend does not solve this problem. You should select colors over a group of charts, not on each individual chart. Use colors consistently to show organizations across charts.

If this crude oil market bubble burst follows the same modus operandi normal market bubble bursts follow I can't see why it is impossible to see a barrel crude oil again at least Bitcoin price prediction 2025 for a little while.

"It's been going down," Paul replied. "Correct, Dogecoin price history and future trends which way have you been trading this market that has been in a clear down trend?" Peter continued. "I haven't been trading it at all, I've just been fully invested, losing money," Paul replied.

Primarily, supply and demand have changed. Industrial demand for silver has increased exponentially the past three decades. In 2010 industrial demand consumed 51% of worldwide production. This ever-increasing industrial demand has resulted in low inventory of physical silver. Less than 10% of the silver mined still exists. On the other hand, over 90% of the gold ever mined still exists, and less than 10% of annual production is used by industrial applications.

Now, if you could make a reliable forecast of long-range changes in the price of gasoline, you could make a killing in the futures market. However, that is beyond the scope of this article. It is, in fact, impossible. Let's just stick with Satoshi (SATS) Price saving a few bucks on our yearly gasoline budget.

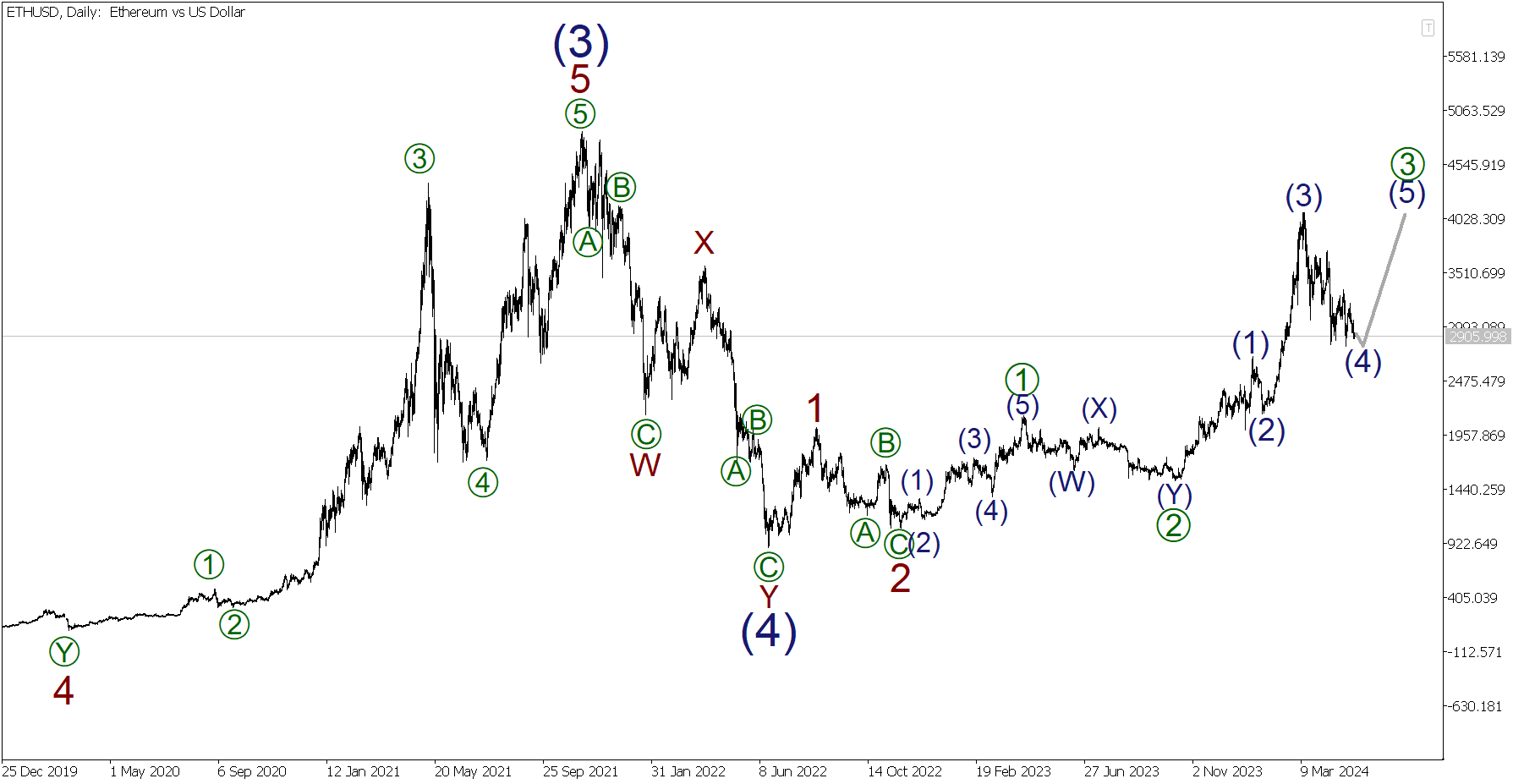

History has a way of repeating itself, which is the foundation of stock analysis. The Fibonacci ratio and its application to stock markets is a wonderful tool in identifying the support and resistance for stock prices.